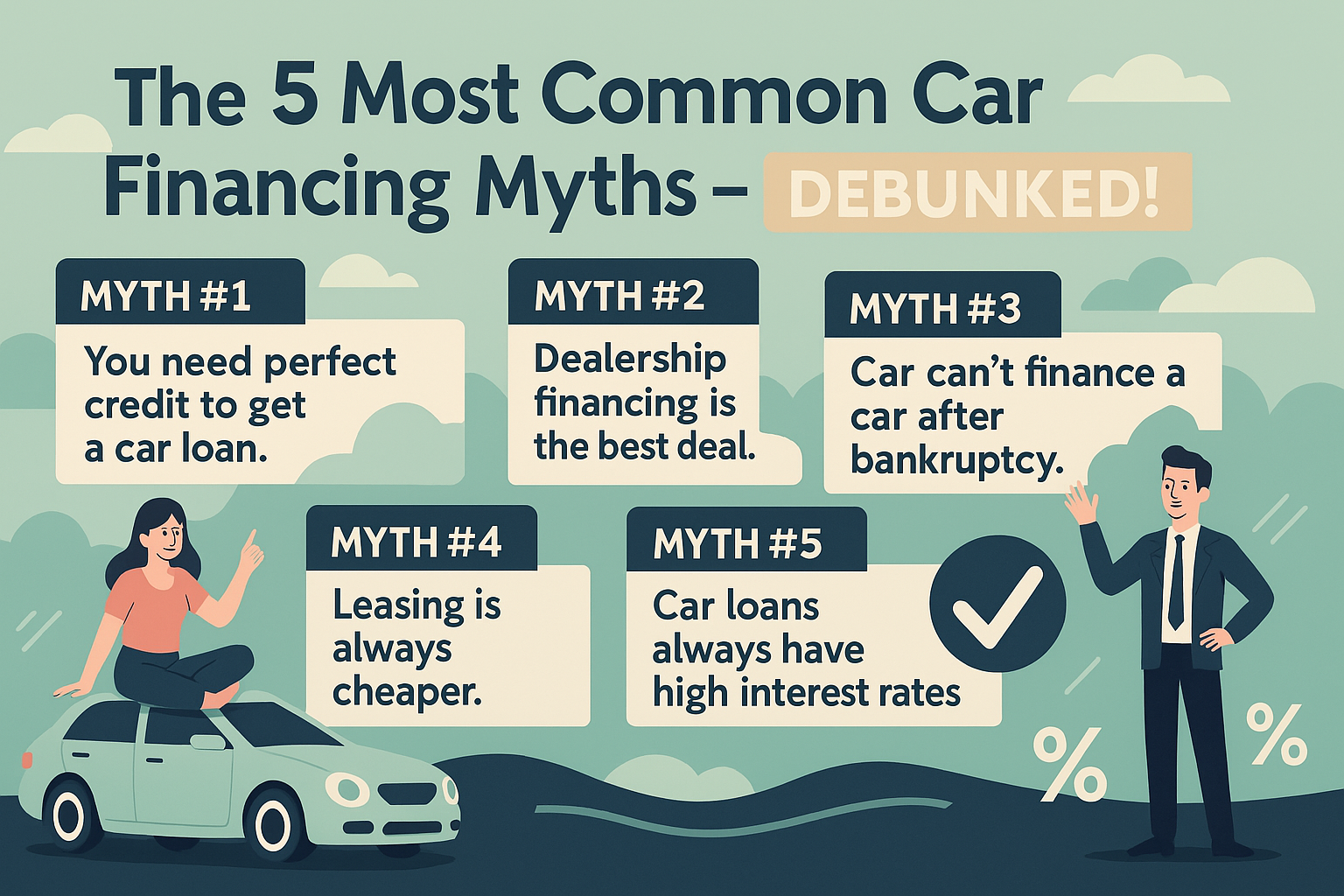

The 5 Most Common Car Financing Myths – Debunked!

The 5 Most Common Car Financing Myths – Debunked!

Buying a car is a big decision, and for many, it can be an overwhelming process—especially when it comes to financing. Just like buying a home, car financing involves a lot of numbers, terms, and decisions that can make anyone’s head spin. And when you’re working on getting that dream car, you don’t want myths and misinformation standing in your way.

I remember the first time I went to buy a car. I had my heart set on a shiny new vehicle, but when the financing options came up, I felt like I was in over my head. The salespeople at the dealership threw terms like “APR,” “down payment,” and “credit score” at me, and I didn’t know where to begin. I was convinced that I’d need a perfect credit score to qualify for anything even close to what I wanted.

But as I started digging into the world of automotive financing, I realized that many of the things I believed were just myths. It was a relief to find out that I could get a great deal even with less-than-perfect credit, and that the financing process doesn’t need to be stressful or confusing. I want to share the truth with you so that you can confidently navigate the car financing world and make an informed decision. Let’s start by debunking the top 5 car financing myths:

Myth 1: You Need Perfect Credit to Get a Car Loan

One of the biggest myths out there is that you need perfect credit to secure a car loan. This couldn’t be further from the truth.

While having a strong credit score certainly helps, it’s not a requirement for financing a vehicle. In fact, there are many lenders and financial institutions that specialize in working with people who have less-than-perfect credit scores. Whether your score is a bit lower due to past financial struggles or just because you haven’t had time to build it up, you still have options.

The truth: Many alternative financing companies, like O-Cal Financial, work with a wide range of credit scores, from those who are just starting to build credit to those with credit challenges. With the right guidance, you can still secure an auto loan with fair rates and terms, no matter your credit history.

Myth 2: Leasing is Always Cheaper Than Financing

Leasing a car might seem like the better financial option for many people, especially if you want lower monthly payments. However, it’s not always the better deal.

When you lease a car, you’re essentially renting it for a set period (usually 2-3 years) and then handing it back at the end of the lease. What most people don’t realize is that you never actually own the car, and you may be subject to mileage limits, wear-and-tear charges, and other fees. In the end, you may have paid as much, or more, than if you had financed the vehicle and owned it outright.

The truth: If you plan to keep your car for many years, financing might be the smarter choice. Even though your monthly payments might be higher than a lease, once you pay off the loan, you own the car and can drive it for years without worrying about monthly payments.

Myth 3: The Dealership Offers the Best Financing Deals

It’s easy to assume that the financing options provided by a dealership are your best option since they often advertise low or 0% APR rates. However, dealerships often mark up the financing rates to make a profit, even if you qualify for a lower rate elsewhere.

The truth: Dealership financing can sometimes come with hidden fees and unfavorable terms. A better approach is to shop around and compare rates from various sources, such as banks, credit unions, or independent financial brokers who work with multiple lenders. By doing so, you’re more likely to find a deal that fits your budget and offers the best value.

Myth 4: You Can’t Finance a Car If You’ve Had a Bankruptcy

Many people believe that if they’ve gone through a bankruptcy, they won’t be able to get approved for an auto loan. It’s understandable to feel that way, but it’s not necessarily true.

The truth: While bankruptcy does affect your credit, it doesn’t mean you’re permanently locked out of financing options. There are lenders who specialize in helping people who’ve gone through bankruptcy and are looking to rebuild their credit. With a little patience and the right guidance, you can still get approved for an auto loan and work on rebuilding your financial future.

Myth 5: Car Loans Always Have High-Interest Rates

High-interest rates are often associated with car loans, but not all auto loans come with sky-high rates. A lot depends on your credit score, the length of the loan, and the type of vehicle you’re purchasing. If you have a good credit score and a strong financial history, you can often secure a loan with an interest rate that’s much more affordable than you think.

The truth: It’s possible to get a car loan with a low interest rate, especially if you shop around and compare offers. Even if your credit isn’t perfect, working with the right financial partner can help you secure a loan with terms that are fair and manageable.

The Power of a Trusted Financial Partner:

When it comes to navigating the complexities of car financing, many consumers go to dealerships and end up paying for unnecessary fees, interest, or hidden costs. Instead, consider a more personalized approach to securing the right car financing deal.

At O-Cal Financial, we take the time to understand your unique financial situation, no matter what your credit score looks like. We are not tied to just one lender or one option. As a financial partner, similar to how a real estate broker helps you find the best home, we work with a network of trusted lenders to ensure that you get the best deal for your circumstances. Whether you have great credit or need some help rebuilding, we’ve got you covered.

We believe that everyone deserves access to fair, transparent, and flexible financing, regardless of their credit history. Our team is here to help you through the entire process, making sure you understand your options and feel confident about your decision.

If you’re ready to find the best car financing option for your needs, without the myths and confusion, reach out to O-Cal Financial today. We’re here to guide you every step of the way—because you deserve to drive away in the car you want, with the financing that works for you.

Call us today to get started on your path to a smarter, more transparent car financing experience.

Related posts

Should I Finance a Car? Here's What to Consider

Auto Finance Doesn’t Have to Be Complicated — Here’s How Emily Got Approved, Fast