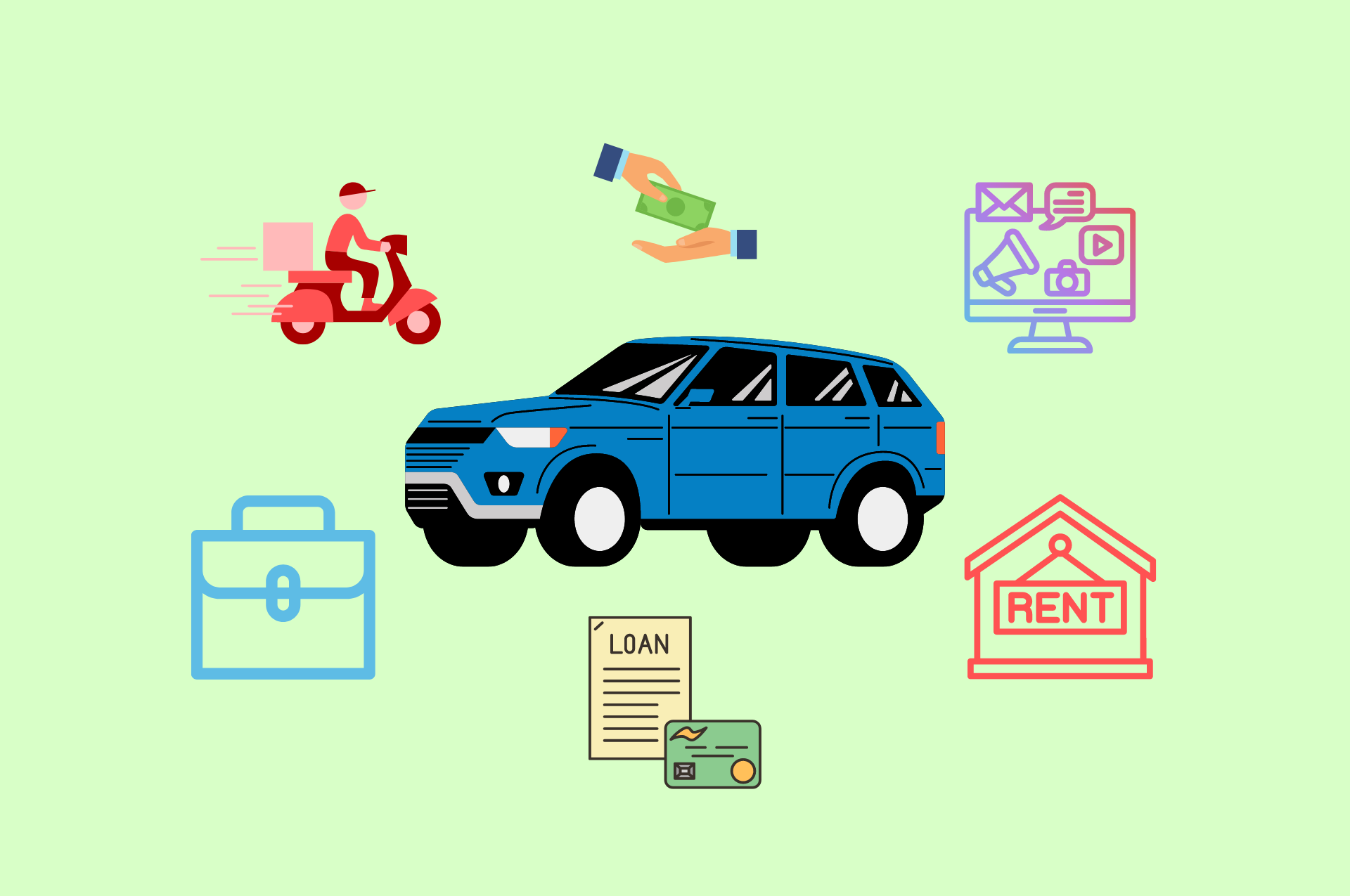

How to Use Your Car as a Financial Asset

Your car is more than just a means of transportation; it can also be a valuable financial asset. By using your vehicle wisely, you can unlock various economic opportunities. Here are some practical ways to use your car as a financial asset.

1. Securing a Car Title Loan

A car title loan allows you to borrow money using your car as collateral. Here’s how it works:

- Equity in Your Car: The amount you can borrow depends on the equity in your vehicle.

- Short-Term Loan: Typically, car title loans are short-term, ranging from 15 to 30 days.

- Risks: If you fail to repay the loan, the lender can repossess your car, so it’s crucial to understand the terms and ensure you can meet the repayment schedule.

2. Ridesharing and Delivery Services

Turn your car into a source of income by working for ridesharing or delivery services:

- Ridesharing: Companies like Uber and Lyft allow you to earn money by driving passengers to their destinations.

- Delivery Services: Services like DoorDash, Uber Eats, and Instacart let you deliver food and groceries.

- Flexible Hours: These platforms offer flexible working hours, allowing you to work around your schedule.

3. Advertising on Your Car

You can earn passive income by turning your car into a mobile billboard:

- Car Wrap Advertising: Companies will pay you to wrap your car with advertisements.

- Eligibility: You’ll need to drive a certain number of km per month in high-traffic areas to qualify.

- Minimal Effort: Once the wrap is installed, you can earn money simply by driving as you normally would.

4. Renting Out Your Car

If you don’t use your car daily, consider renting it out:

- Peer-to-Peer Car Rental: Platforms like Turo allow you to rent your car to others when you’re not using it.

- Extra Income: Renting out your car can provide a steady stream of extra income.

- Insurance Coverage: These platforms typically offer insurance coverage for your vehicle during the rental period.

5. Using Your Car for Business

If you’re self-employed or run a small business, your car can be a valuable business asset:

- Tax Deductions: You can claim tax deductions for business-related mileage, reducing your taxable income.

- Mobile Office: If your work requires travel, your car can serve as a mobile office, saving on overhead costs.

- Transportation of Goods: For businesses that involve transporting goods, your car is an essential asset.

6. Refinancing Your Auto Loan

If you have an existing auto loan, refinancing it can save you money:

- Lower Interest Rates: Refinancing can help you secure a lower interest rate, reducing your monthly payments.

- Better Terms: You can negotiate better terms, such as extending the loan duration to lower monthly payments.

- Improved Cash Flow: Lower monthly payments can improve your cash flow, freeing up funds for other investments or expenses.

Conclusion

By thinking creatively and leveraging the potential of your vehicle, you can transform your car into a powerful financial asset. Whether it’s earning extra income through ridesharing and delivery services, securing a loan, or taking advantage of advertising opportunities, your car offers numerous ways to boost your financial health. At OCAL Financial, we’re here to help you explore these options and maximize the value of your vehicle. Contact us today to learn more about how we can assist you in making the most of your car as a financial asset.

Related posts

Auto Finance Doesn’t Have to Be Complicated — Here’s How Emily Got Approved, Fast

How Vanessa Fell in Love with Her 2019 Jeep Compass & How OCAL Helped